Most of us aren’t billionaires. We don’t have private jets, own a helicopter or rub elbows with the rich and famous. And that’s perfectly fine. Personally, having a happy marriage, healthy kids and a profession I enjoy are more important to me than extravagant luxuries, but even I can’t deny jolts of jealousy, envy or maybe even regret when I see the life of a wealthy celebrity.

But here’s the crux:

Don’t be fooled. We in the middle class may say or even believe that we are capable of just “shaking off” these feelings. However, unfortunately, these images navigate their way to our hearts (subconsciously) and impact our life decisions down the road.

My job is to help the middle class minimize their money mistakes that result from being influenced by politicians, Pinterest and primetime television. Today, our middle-class money is ridiculously manipulated by the outside world. But enough is enough. It’s time to stiff-arm the pressure and take back control.

How you get that control are healthy guidelines and a financial group that truly understands the middle class.

It feels disingenuous when politicians or hedge fund managers talk about the importance of the middle class. It seems that a central theme of every campaign trail is the need for a strong middle class, yet many politicians have no idea how higher income taxes or healthcare costs restrict the middle class’ ability to put kids in tutoring. Sometimes it seems that no one authentically cares how the rising cost of tuition forces Dad to take a job where he has to travel across the country.

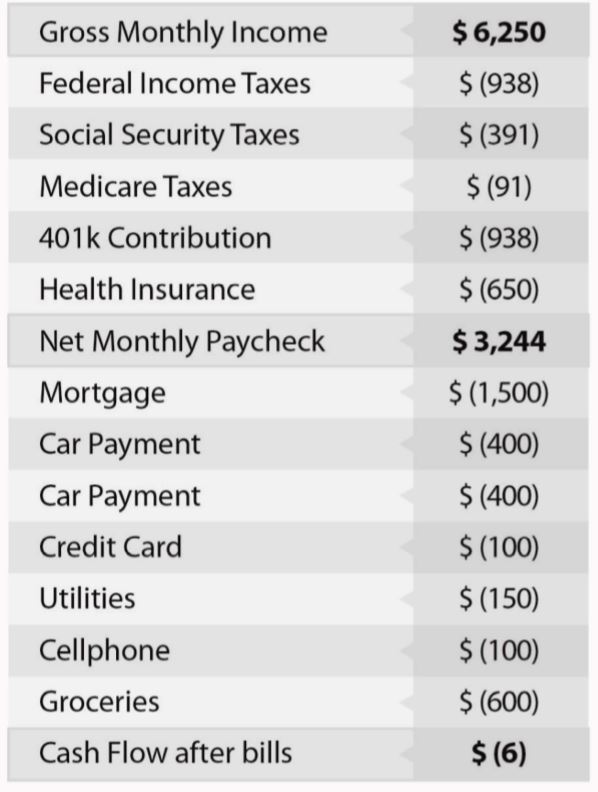

The reality is that middle-class money is tight and every dollar is accounted for. Below is a typical middle-class budget in America today:

Where is the money for braces, gymnastics, birthday gifts, summer camps and school supplies? It’s gone.

So, Who is the Middle Class?

The Pew Research Center states that the range of those in middle-income households was from $42,000 to $125,000 in 2014. But if you dig a little deeper, it really depends on a few other factors. For example, even if you have high income, you are going to be “middle class” if you have six children. You’re also more likely to be “middle class” if you live in expensive communities.

The U.S. Department of Commerce defined “middle class in America” in a 2010 report this way: “…aspirations for homeownership, a car for each adult, health security, a college education for each child, retirement security, and a family vacation each year.”

So, if you have those aspirations, you may be middle class.

If you fall in the category, it’s important to work with the right financial group; to work with a financial advisor who understands the struggles of the middle class. The focus should be clear. There should be no “rich” financial talk and “poor” financial talk. The right advisor should focus on the middle class.

Money struggles are difficult and unfortunately, often lead couples to divorce. It’s crucial to create good money guidelines and receive advice from a financial group that understands these struggles – what it means to fight and scratch to find a way to send kids to college.

A lot of middle-class adults have a retirement dream but can’t see how they will ever reach them. Many feel that one little mistake will wipe away their chance of “making it.” But they may just need some sound advice.

Saving May Seem Impossible, But It’s Not

You’ve surely heard stories of couples who’ve committed to drive 18-wheelers across the country to be debt free and therefore, accumulated more wealth than attorneys and doctors. Or the couple that decided to deliver pizzas to get financially right despite having advanced educations and full-time leadership careers, then paid off their house by age 40 with only a modest income. But life doesn’t have to be that dramatic. There are many stories of families who got focused and stiff-armed American consumerism and the pressure to spend.

But it takes discipline. It takes the kind of discipline that Odysseus had in Greek mythology. He was curious about the beautiful Sirens who sang passerby sailors to their death. So, on the advice of Circe, he had his sailors plug their ears with beeswax while he was tied securely to the mast of the ship. He ordered his men not to untie him under any circumstances. As a result of developing a system of self-control, he was one of the few to ever enjoy the Sirens’ song.

We must have that same discipline. Recognizing the threats and our own personal weaknesses are key character qualities when accumulating wealth. As an example, if you want to eat out, but are on a budget, then drink water and commit to split the meal with your spouse. If you tend to spend everything you make, then force yourself to save 15 percent before your paycheck ever hits your bank account.

The right financial group can help you take a holistic approach to your financial planning and create “rules” that you’re able to follow to reach what you dream of doing in retirement. You just need to make sure you’re working with the right group.

Contact PAX Financial Group to see if we can help. A full-service financial firm, we offer financial assessments, retirement planning, investment management, insurance and practical advice in one place.

This material is provided by PAX Financial Group, LLC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The information herein has been derived from sources believed to be accurate. Please note: Investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results.