Budgeting, saving, and investing are all integral parts of a good financial plan. However, all good plans involve diligent estate planning.

Estate planning provides peace of mind to both those planning and the ones who will inherit the assets left behind. Knowing your affairs will be handled according to your wishes and that you have chosen the appropriate guardians and trustees to enact your plan is no small thing.

Therefore, a solid estate plan is imperative to your financial plan. There are many financial planning tips to take note of when getting your estate that we will review in the article below.

Use Our Estate Planning Guide To Learn About Ways You Can Protect Your Wealth And Pursue Your Financial Goals With The Assistance Of A San Antonio, Tx, Financial Advisor.

Creating A Solid Estate Plan In Texas

To establish a solid estate plan, you first need to take inventory of all the assets you plan to leave behind, then decide what you would like to leave to who. This may take some time, but the next step would be to consider your personal preferences regarding medical care and who you would prefer to handle your affairs if you die or become incapacitated. For those with minor children, consider prospective guardians for them in the event of your passing.

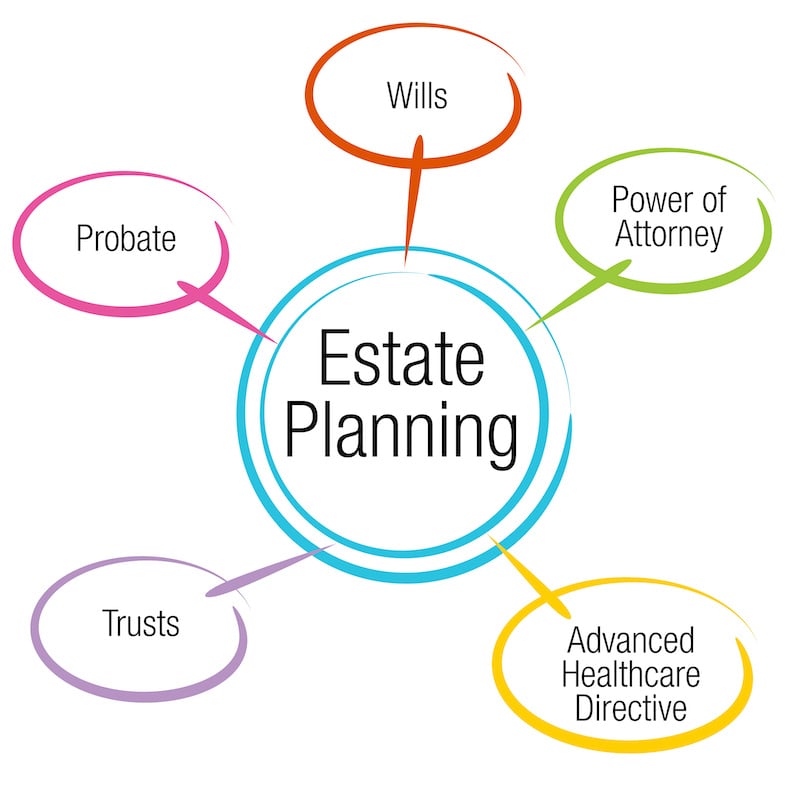

There are a few notable documents to potentially include in your estate plan:

- Wills and Trusts: Both wills and trusts allow you to enact your wishes after your death. A last will and testament enables you to name a person (executor) to handle your affairs after you die and also state who you would like specific property to go to. A will also allows you to name guardians for any minor children you leave behind. If you die without a will, it is called intestate, which means the government now gets to distribute your assets in accordance with your state’s laws. Oftentimes, how they divide up the assets is not looked favorably upon.

Living trusts allow you to place your assets in a trust while you are alive. You can then have those assets transferred directly, avoiding probate, to whoever your chosen beneficiaries are upon your death. Living trusts are a great way to avoid the additional time and expenses of probate and expedite the transfer process.

- Health Care Directives: Both living wills and advance directives give you the opportunity to give instructions on any medical care you wish to receive in the event you are rendered unable to communicate your wishes. Both allow you to include instructions regarding life-sustaining measures. Living wills typically do not cover a health care power of attorney, while advanced directive functions both as a living will and a health care power of attorney.

- Power of Attorney: A POA grants someone of your choice the authority to handle your affairs. A durable power of attorney grants someone that legal authority even if you are incapacitated. A financial power of attorney grants powers only regarding financial matters, while a health care power of attorney is granted authority in decisions regarding health care.

- Life Insurance: Life insurance ensures your loved ones are taken care of financially after your death. Life insurance protection is a widely appealing asset, especially for those with young children and with significant debt.

Integrate Your Estate Plan With Your Financial Plan

Always remember: your estate planning attorney and your financial advisor work for you. Your financial planner and estate planner should work together to avoid any future legal issues and integrate your estate plan well into your overall financial plan.

All decisions regarding beneficiaries, special gifts and requests, and who you believe should be left in charge should all be run by your financial advisory firm and the law firm handling your estate.

The combined advisory services of both your attorney and financial advisor should all but ensure that all contingencies have been properly outlined in creating your estate plan. All appropriate Texas estate planning should be incorporated smoothly into your overall financial plan, including retirement planning and wealth building as well.

For reliable estate planning in San Antonio, TX, contact our Texas financial advisors at PAX Financial, where we have an accomplished and experienced team of registered investment advisors and financial planners who can answer all of your questions regarding estate and financial planning.

Why You Should Combine Both

Compartmentalizing the different aspects of your plan can be beneficial; however, all the different pieces need to come together at the end to make a whole. Your estate planning attorney can provide the necessary legal advice, while your financial advisor provides solid investment advice. Bringing everything together and having everyone on the same page is a tried and true way to ensure your finances and estate plan are tied together seamlessly.

Having your advisor or attorney out of the loop only presents future problems. Playing telephone between the two increases the likelihood of something being lost in translation, to the detriment of your assets and estate plan.

Everyone being on the same page also makes the job easier for everyone involved too, which they will likely welcome with open arms.

Conclusion

Neither estate planning nor financial planning is a one-time thing. Both require semi-regular updates and maintenance. Continuing engagement is absolutely necessary to ensure adequate wealth management. This can only be achieved through a smooth and harmonious integration of different strategies and viewpoints, as this is the optimal way to find the best strategy for your situation.

Delegating certain tasks to specific people with expertise is a great way to handle your estate and finances, although the two should come together for a comprehensive wealth management plan.

To best serve you, the PAX team of CERTIFIED FINANCIAL PLANNER™ professionals, Accredited Investment Fiduciaries ®, and insurance professionals will address your unique needs as they come up. We are passionate about investing and planning and would love to explore the best type of strategies to serve you and your family better.

This material is provided by PAX Financial Group, LLC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The information herein has been derived from sources believed to be accurate. Please note: Biblically Responsible Investing(“BRI”) involves, among other things, screening for companies that fit within the goal of investing in companies aligned with biblical values. Such screens may serve to reduce the pool of high performing companies considered for investment. Investing involves risk. BRI investing does not guarantee a favorable investment outcome. PAX Financial Group has conducted due diligence for their Biblically Responsible Investing (BRI) process and proudly serves as each client’s advocate using fully vetted third-party specialists for the administration of BRI methodology. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax, or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product and should not be relied upon as such.